Investing in CAU’s Future—With Impact That Lasts

Clark Atlanta University (CAU) thrives through support of endowments, annual scholarships, and securities—advancing student success, academic excellence, and long-term financial stability. Explore the many ways to give and create lasting impact while aligning your philanthropy with personal values and supporting future generations of Panthers.

Endowments at Clark Atlanta University (CAU)

An endowment is a permanent philanthropic investment that supports Clark Atlanta University in perpetuity. Gifts are strategically invested, with a portion of annual earnings used to fund scholarships, faculty support, academic programs, or other donor-designated priorities—while the principal remains intact to ensure long-term impact.

Endowments can be built over time and structured to align with individual financial goals, offering flexible commitment options while meeting University minimums. Establishing an endowment is a meaningful way to create a lasting legacy at CAU.

How an Endowment Gift Works

(Illustrative Example)

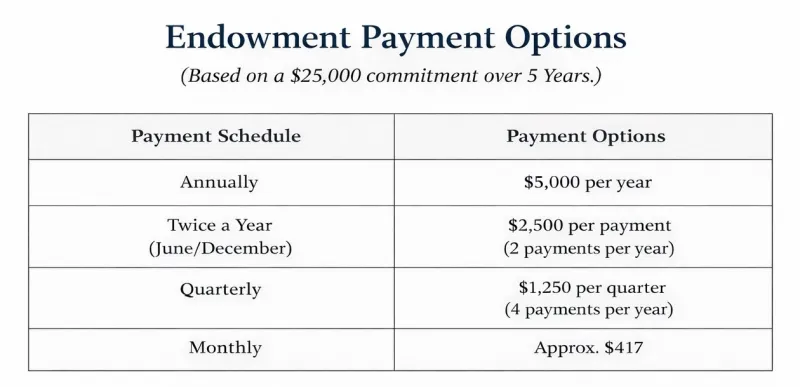

Endowment gifts are typically fulfilled over a multi-year period, allowing donors to make a lasting impact through flexible payment options. This illustration reflects one possible approach. Actual gift amounts, timelines, and structures may vary based on donor preference and University guidelines.

Sample Endowment Illustration: $25,000 Commitment

Once fully funded, the endowment is invested to provide support in perpetuity, generating ongoing resources each year for its designated purpose—such as scholarships, academic programs, or faculty support—while preserving the principal.

Annual Scholarships

Annual Scholarships: Immediate Student Impact

Annual scholarships provide donors with a meaningful way to deliver immediate, year-to-year support for Clark Atlanta University students. These funds are distributed to students each year and used in full to support current financial needs.

- $1,500 Annual Scholarships may support book scholarships and do not include naming recognition.

- $2,500 Annual Scholarships include naming recognition, allowing donors to establish a scholarship in honor of an individual, family, organization, or class year.

- Annual scholarships can be supported at any amount, based on the donor’s discretion, with the levels above serving as suggested starting points.

Annual scholarship support helps students thrive today while strengthening CAU’s commitment to access, retention, and achievement.

Gifts of Securities (Stocks & Bonds)

Supporting Clark Atlanta University (CAU) through Appreciated Securities

Contributing appreciated securities, such as stocks or bonds, is a highly tax-efficient way to support CAU. By donating these assets, you can potentially enjoy significant tax benefits while making a meaningful philanthropic impact.

With this form of giving, you can avoid capital gains taxes and may qualify for an income tax deduction based on the full value of the donated securities, provided you have held them for more than one year. If you have stock or bond certificates that you would like to transfer to CAU and receive tax credit for your gift, our team member is here to assist you through the transfer process.

Donor-Advised Funds (DAFs)

A Donor-Advised Fund (DAF) provides a simple, tax-efficient way to support Clark Atlanta University. Donors receive an immediate tax deduction and may recommend grants to CAU at their discretion—whether through one-time or recurring support—while managing their philanthropy through a single account.

To make a gift, log in to your donor-advised fund account or contact your fund administrator and submit a grant request using:

Tax ID #: 58-1825259

Qualified Charitable Distributions from your IRA

A Qualified Charitable Distribution (QCD) allows individuals age 70½ or older to make a direct gift from a traditional IRA to Clark Atlanta University. QCDs may count toward your Required Minimum Distribution (RMD)—the minimum amount the IRS requires withdrawals to begin at age 73—and are excluded from taxable income.

To make a QCD, contact your IRA custodian and instruct them to distribute funds directly to Clark Atlanta University. Annual limits apply.

By making a QCD, donors can meet IRS requirements while supporting CAU’s mission and the student experience.

Honorary & Memorial Gifts

Honorary and memorial gifts provide a meaningful way to celebrate, honor, or remember someone special while supporting Clark Atlanta University. Gifts may be directed to scholarships, academic programs, or the University’s general operating fund.

In addition, honorary and memorial gifts may be used to establish named scholarships or endowments, creating a lasting tribute that supports CAU for generations.

When a gift is made, the University will notify the individual or family you designate, unless anonymity is requested.

We’re Here to Help You Explore Your Options

Whether you are considering an endowment, annual scholarship, honorary or memorial gift, or a securities transfer, the Institutional Advancement team at Clark Atlanta University is available to assist you. Our staff works closely with donors to explore giving options and structure gifts that align with personal goals and philanthropic priorities. Visit our Staff Directory to connect with a member of our Institutional Advancement team who can assist you.

Your generosity builds opportunity. Your legacy shapes the future.

Office of Institutional Advancement

Phone Number: 404-880-6040

Email Address: dfraboni@cau.edu

205 Harkness Hall

223 James P. Brawley Dr., S.W., Atlanta, GA 30314